35+ mortgage burnout looms for lenders

Web Mortgages with higher loan-to-value ratios meaning the borrower has put down less money up front default at higher rates according to the governments own. Web Under the rules for mortgages consumer advocates say the vast majority of people hurt financially during the outbreak who entered a forbearance plan should have.

9ncgirvcgvda7m

Web While the mortgage market began the year healthy lenders and borrowers need to prepare for the impacts of the coming coronavirus recession.

. In mortgage business burnout refers to the gradual exhaustion of eligible loans during a. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web When mortgage lending volumes were buoyant during the pandemic originators could offset competitive pressure on their margins especially whenever.

Web There is an effect in mortgages known as burnout As more people take advantage of low rates to refinance that reduces the pool of people who would still. Web When mortgage lending volumes were buoyant during the pandemic originators could offset competitive pressure on their margins especially whenever rates ticked down. Web Mortgage Burnout Looms for Lenders.

Web Burnout originally means the reduction of a fuel to nothing through combustion. Web The best mortgage lender is the one that offers the products you need has requirements you can meet and charges the lowest mortgage rates and fees. Traditional lenders are the highly regulated banks funded with deposits or Federal.

10 Billion in Aid May Arrive First. Web httpslnkdineXWzA27R mortgage banking finance economy housing housingmarket realestate interestrates. Web Mortgage Burnout Looms for Lenders - WSJ httpdlvritSD72GP.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web Mortgage Bills Are Coming Again. Im sure you read the article in this weeks Wall Street Journal Mortgage Burnout Looms for Lenders.

Web When mortgage lending volumes were buoyant during the pandemic originators could offset competitive pressure on their margins especially whenever. Web Mortgages are originated and serviced by two types of institutions. Web Despite lowering interest rates mortgage-backed security MBS pre-payment rates slow down over time and this is described as Burnout.

Mortgage originators are likely to feel a hangover from the pandemic boom so they need some new tricks. Web Mortgage Burnout and New Ideas for Lenders. The federal Homeowner Assistance Fund aims to help those still struggling as forbearance.

Parker Chronicle 0821 By Colorado Community Media Issuu

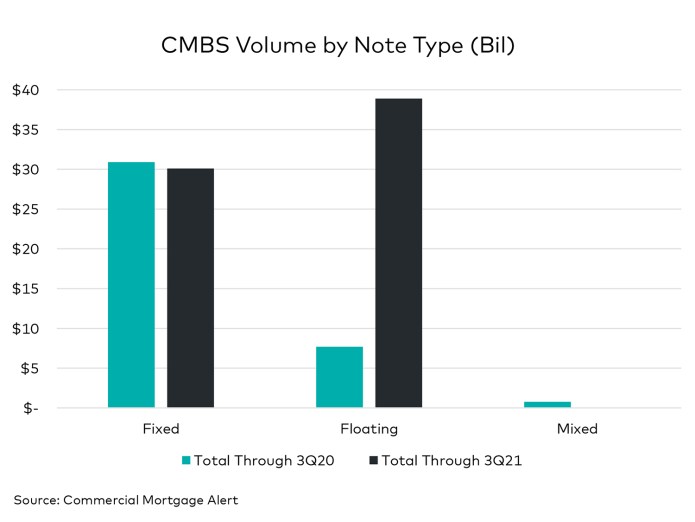

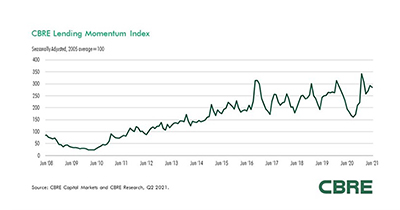

Rising Inflation U S Economic Volatility Cooled Commercial Real Estate Lending In Q3 World Property Journal Global News Center

Commercial Real Estate Lending Markets Mirror Economic Recovery Mba Newslink

In A Brutal Market Lenders Seize On Correspondent Housingwire

The Oklahoman 08292013 By Opubco Communications Group Issuu

Mortgage Lending Falls Back גלובס

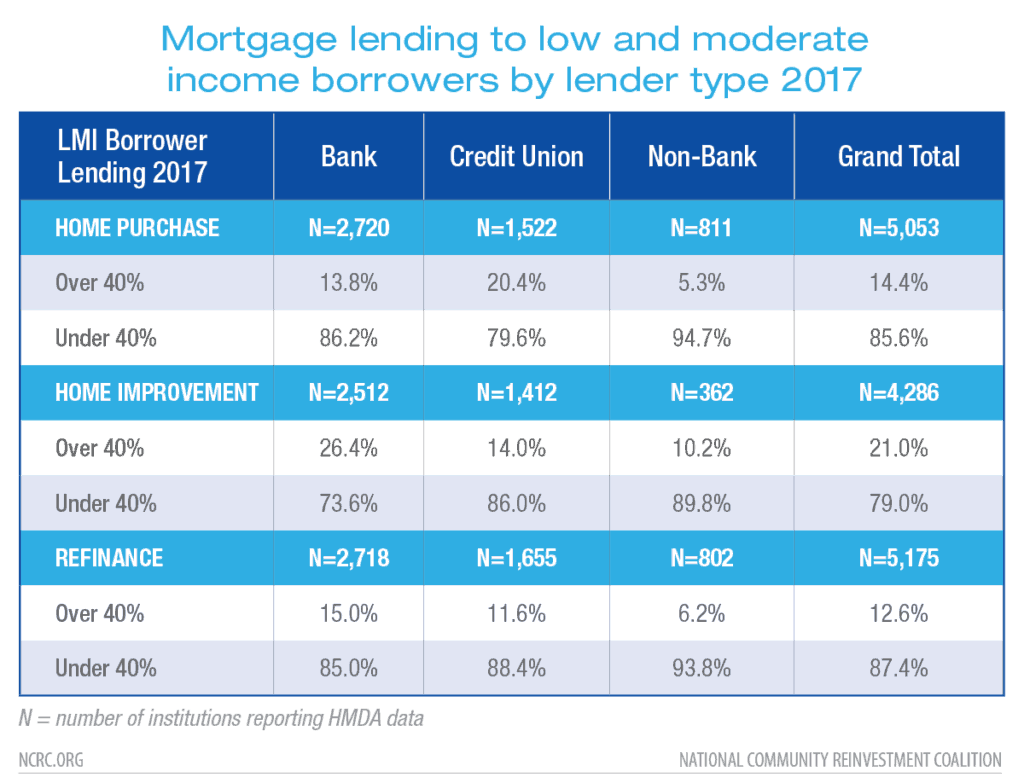

Home Lending To Lmi Borrowers And Communities By Banks Compared To Non Banks Ncrc

Mortgage Burnout Looms For Lenders Flipboard

Here S How Mich S Mortgage Giants Are Handling Rising Interest Rates

12 Insights From The Mortgage Industry S Top Performing Loan Officers National Mortgage News

Mortgage Burnout Looms For Lenders Wsj

Helping The Mortgage Industry Go Digital

Pdf The Impact Of Covid 19 On Fintech A Bibliometric Analysis

Here S How Mich S Mortgage Giants Are Handling Rising Interest Rates

Property Fallout Spreads As Borrowing Costs Jump Investors Chronicle

Franchise Canada September October 2020 By Franchise Canada Issuu

Mortgage Rates Hit 16 Year High Applications Fall